One of the key aims of the government’s recent overhaul of the Alcohol Duty Scheme was to raise awareness of alcohol abuse, stop people drinking so much, improve people’s health, the usual stuff from the Institute of Alcohol Research – a pressure group funded by the Temperance Movement. And they got their way, in a way.

The Duty limit for low strength beers has risen, from 2.8% abv to 3.5% abv, but the higher strength has also risen from 7.5% to 8.5% abv, this allows breweries to produce low strength beers and pay a lot less Duty by making their core beers 3.4%.

We’re already seeing this happen with Carlsberg reducing the strength of their Pilsner from 3.8% abv to 3.4% abv. That’s a bold move, and already some pubs are looking at replacing it on their bars, a lot of others are tied into contracts though and can’t replace it.

So why are they reducing the strength that much? Is it worth it?

Well, in 2022 Carlsberg sold 651,246 hectolitres. The new rate for beer is £21.01 per litre of pure alcohol.

So 65,124,600 litres of beer * 3.8% abv is 2,474,734.8 litres of pure alcohol.

At £21.01 per litre, that’s £51,994,178.15 in Duty that Carlsberg would be liable for on their Pilsner sales.

Except, that’s at the basic rate, not the new Draught Relief Rate which is £19.08

So 2,474,734.8 litres at £19.08 a litre is £47,217,939.99 that they’re liable for.

Just with the Draught Rate Relief alone, on the Pilsner alone, Carlsberg are in line to save £4,776,238.16 a year.

If Carling, the biggest selling lager did this too, they’d save £15,557,149.29 a year.

Yeah, a saving of £15.5 million

Not being satisfied with that though, there’s the Low Strength duty rate. For draught beers less than 3.5% abv this stands at £8.42 per litre of pure alcohol.

So Carlsberg’s 65,124,600 litres of beer * 3.4% abv is now only 2,214,236.4 litres of pure alcohol.

At £8.42 a litre that’s now just £18,643,870.49 Duty liable.

So with the new Draught Duty Relief and by lowering the abv from 3.8% to 3.4%, Carlsberg are looking to save £33,350,307.66.

Carling would be looking to save a whopping £108,624,449.97 if they did the same.

So yeah, it is worth it for them to lose a few pubs here and there, and don’t expect the price of a pint to drop either, that money will be used to buy up pubs or tie up lines in freehouses.

At the other end of the scale brewers are really getting punished.

Previously if a small brewer made a beer of less than 7.5% abv they could claim Small Brewers Relief on it. If they made a beer of 7.5% or above, they could claim Small Brewers Relief on the alcohol below 7.5%, only paying the full duty rate on the part of the beer above 7.5%. With the new system that limit has raised to 8.5% abv, but there is no relief available on any part of that beer. All 8.5% is now charged at the full higher rate.

If that in itself wasn’t bad enough, even though there is no relief on the beers of 8.5% and above, the alcohol in it counts towards the brewery’s annual pure alcohol production, meaning that they pay a higher duty rate on their lower strength beers.

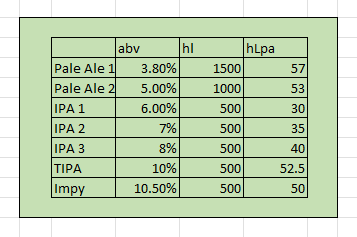

To put this into context we can use these production volumes from a fictional yet typical small craft brewery that does lower strength cask and higher strength keg.

This brewery would be producing a total of 5,000hl a year, with the TIPA and Impy accounting for 1,000hl of that, a fifth of their production.

Yet when we look at the amount of alcohol that is involved we see this:

A total of 317.5 hectolitres of pure alcohol a year, with the TIPA and Impy accounting for 102.5 hLpa, just under a third of the entire alcohol production from this brewery.

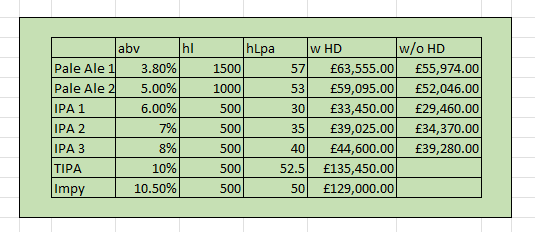

With these production figures, this brewery would have a base duty rate of £12.28 per litre of pure alcohol for packaged beer, and £11.15 for draught beer.

Or to put that another way, each of their 40 litre casks of Pale Ale 1 would be liable for £16.95 in duty. High strength beer is not liable for any relief, including draught relief, so the stronger beers are charged at the new base of £25.80 a litre of pure alcohol. So their 30 litre kegs of TIPA would be liable to £77.40 in duty.

The difference in Duty rates between lower strength, mid-strength and higher strength beers is huge, and it’s potentially going to cripple smaller breweries looking to keep producing higher strength beers.

For example, if this brewery didn’t produce those two high strength beers, their base duty rate would be £10.81 and their draught rate £9.82.

So if all of their beers were on draught we’d see this difference:

Taking the duty on the stronger beers aside for the moment, the duty for the rest of the beers brewed on site is £239,725, whereas if they didn’t brew the stronger beers it would be £211,130.

The additional Duty cost to this brewery for brewing strong beers is £28,595

But here is a possible solution to this, and a business opportunity for the right brewers, maybe some of the amazing ones we’ve recently seen become redundant.

Because high strength beer, 8.5% and above does not qualify for any relief at all, it doesn’t matter how much of it you brew. If there was a brewery that only made beer of 8.5% and above, let’s call it High Strength Brew Co, whether it made 1,000hl or 100,000hl a year, it would all be liable to £25.80 per litre of pure alcohol.

And it doesn’t matter who it is brewed for. This is quite an important part of the new system that seems to have been overlooked.

When a beer is contract brewed, it is the brewery that brews it that is liable for the duty, and therefore the alcohol production is counted towards that brewery that brewed it.

So if our example brewery were to get their TIPA and Impy contract brewed at High Strength Brew Co, they would be able to claim the lower duty rate on the rest of their beers.

So as long as getting the beers contract brewed didn’t cost £28,595 more than brewing them in-house, then they would be able to save money.

So if we want to see high strength beers saved, we need a High Strength Brew Co to set up and contract brew for everyone, cheaper than it’d affect their own duty rates.