PLEASE NOTE: This article has been updated since it was first published to take into account the finalised details of the changes to the Alcohol Duty System, and some of the comments and replies may therefore seem out of place. They were very valid at the time.

In the previous piece on the changes to the Alcohol Duty System I covered what’s changing in general. That production volumes are now measured in litres of pure alcohol rather than litres of beer or cider, and the introduction of the new Band 1 which provides a 100% Duty relief for Cider and Made Wine (fruited ciders) and 90% Duty reflief for Beers and how all drinks of 8.5% and above don’t now qualify for any relief.

In this follow up piece I’ll go a bit more in-depth as to what that actually means for a brewery or cidery, and how to work it out.

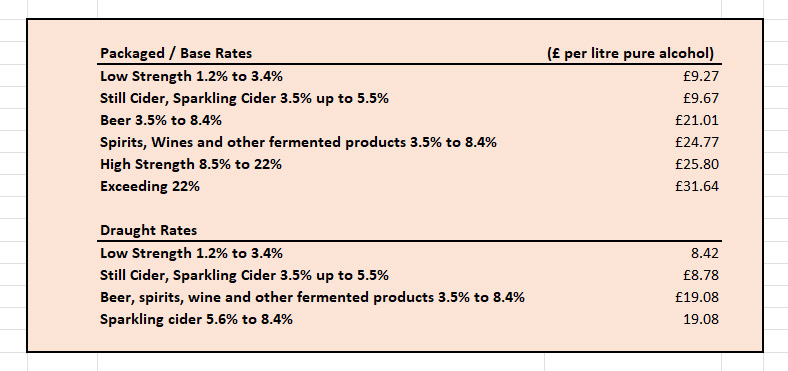

To start with, here are the new Duty rates:

The current Small Brewers Relief scheme allows for breweries producing under 5,000 hectolitres (500,000 litres) to get a 50% relief on the Duty liable. Between 5,000 and 60,000 hectolitres the rate of relief tapers off until at 60,000 breweries pay the full amount of Duty.

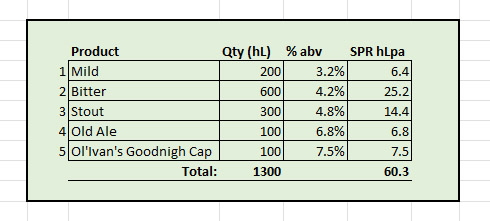

To properly understand how the new Small Producers Relief scheme works we’ll look at an example of annual output from a small microbrewery:

With a total production volume of 1,300 hectolitres this brewery would get a straight 50% Duty relief, except for the Ol’Ivan’s Goodnigh Cap which at 7.5% would be liable to High Strength Beer Duty on top of the 50% relief.

For the new system though, breweries must work out the amount of pure alcohol that is produced. To get this we multiply the quantity of each product by its abv.

From this we can see that this brewery produces 6,030 litres (60.3 hectolitres) of pure alcohol a year. This total production figure covers all alcoholic drinks made by the producer, including any High Strength Beers. But with the new scheme the threshold for high strength beers is now 8.4% rather than 7.4%, so Ol’Ivan’s Goodnigh Cap now qualifies for Duty relief.

It’s this figure of 60.3 hLpa that is now used to determine which of the new Bands the brewery or cidery is in, and therefore how much Duty they pay by using a complicated looking formula of:

D = (( C + ( M * ( P – S ))) / P

Where:

D is the discount in £ per litre of pure alcohol

C is the cumulative discount for the band

M is the marginal discount for the band

P is the production in hectolitres of pure alcohol (hLpa) in the previous year

S is the start threshold of the band

The marginal discount is the amount per litre that the brewer can claim, and the cumulative discount is a bit of an add-on so that those producing larger amounts still get a fair relief, helping to pass the benefit of the Band 1 100% relief up the scale but without giving larger producers an amount of Duty-free alcohol. All of these figures are in the government look-up tables.

For this example, the brewery would be in Band 2 for packaged beer and the formula would look like this:

((£94.55 + (£10.51 * (60.3 – 5))) / 60.3 = £11.21

With a base rate for Packaged Beer set at £21.01 this brewer would be paying £9.80 per litre of pure alcohol.

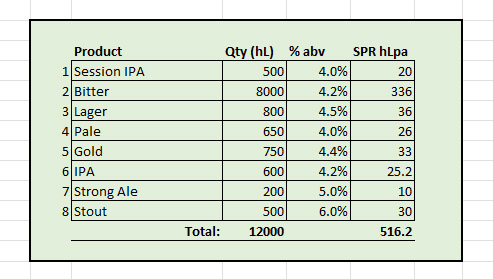

If we now look at a larger brewery producing 12,000hl of beer each year:

We can see from this table that they would be producing 516.2 hLpa and for this brewery would be in Band 5 and the formula for Packaged Beer would be this:

((£3468.75 + (£3.15 * (516.2 – 450))) / 516.2 = £7.12

Again, with a base rate for Packaged Beer at £21.01, this brewer would be paying £13.89 per litre of pure alcohol.

Now let’s look at the smallest end of the scale, that of a brewpub producing two firkins (40 litres) one week, and a firkin and a 30 litre keg the alternate week across a range of styles:

For this brewpub the formula would look like this:

((£0 + (£18.91 * (1.96 – 0))) / 1.96 = £18.91

And with the base rate at £21.01 the brewery now be paying £2.10 per litre of pure alcohol Duty, that’s a 90% relief instead of the current 50% relief from the Small Brewers Relief scheme.

This is the effect of the new Band 1 Duty rate which has come into the Small Producers Relief from the Farm Gate Allowance afforded to Cider makers who are now included in the scheme.

So, we should really look at what a cider maker would pay, although firstly we need to be aware that Duty on Cider is a lot more complicated than Duty on Beer. One of the main reasons for this is that cider isn’t always Cider as far as HMRC are concerned. As soon as you add some fresh fruit or some hops, it becomes Made Wine. This is a whole other discussion for another time, and there is a government consultation planned later this year about what defines Cider. But for now, Ciders between 3.5% abv and 8.49% abv and Sparkling Ciders (cork and cage bottles, high carbonation) are taxed as Cider, Sparkling Ciders over 5.5% and Made Wines are now classed together in the same category of “Spirits, Wine and Everything Else 3.5% to 8.49% and Sparkling Cider over 5.5%.”

The previously mentioned Farm Gate Allowance meant that cider makers could produce up to 70hl of cider each year and not pay any Duty on it. However, they did have to pay Duty on all the Made Wine they produced.

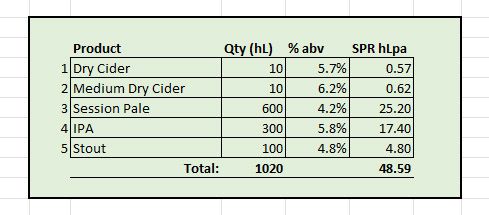

If we look at a typical production amount for a small-scale cider producer we can see that there’s 70hl of cider, and 5hl of Made Wine:

Having two categories of drinks here (cider and made wine) means that we have two formulas to work through. Again, with the hLpa being below 5 this producer is in Band 1 of both categories.

The first is for Cider:

(( £0 + ( £9.67 * (4.5 – 0))) / 4.5 = £9.67

And with the base rate for Packaged Cider being £9.67 that means that the producer will still pay £0 Duty on their cider.

The second formula is for the new category that trips easily of the tongue and includes Made Wine in the “Everything Else” part:

(( £0 + ( £24.77 * (4.5 – 0)) / 4.5 = £24.77

The base rate for this category is £34.77, so again we can see that this producer will now pay £0 Duty on their Made Wine.

This is a massive benefit for cider makers adding fruits and hops to their ciders. Previous at a current rate of 126.08 pence per litre, for those 500 litres that they produce they would have paid £630.40 in Duty. This might not sound like much of a saving, but that really is at this scale.

The producers that lose out with this new system though are those that have both a brewery and a cidery. And there are a few of these about, Little Earth Project and Chapter are two breweries with associated cideries. Any breweries and cideries that are seen as “connected” will have the total outputs of all sites combined to measure their joint alcohol production.

Connected by HMRC’s definition is if owners are related by marriage or similar relationships, partners in the businesses are related or their spouses are related, anyone with control of the company and also has control of another company (basically the largest shareholder). With an example of this setup we can see these sorts of production levels:

Again, we have two formulas to work with, one for beer from the brewery and one for cider from the cidery.

For beer we are in Band 2 and have:

(( £94.55 + (( £10.51 * (48.59 – 5))) / 48.59 = £11.37

With the base rate for Packaged Beer at £21.01 that means that this producer will pay £9.64 per litre of pure alcohol on their beers.

For cider it’s also in Band 2, whatever band you’re in for one, you’re in for them all and the formula looks like this:

(( £48.35 + (£2.42 * (48.59 – 5))) / 48.59 = £3.17

The base rate for Packaged Cider is £9.67 so the producer is now liable for £6.50 per litre of pure alcohol on the cider that previously they didn’t have to pay.

With those production figures above that’s 1,000 litres of 5.7% is £370.50 Duty, and 1,000 litres of 6.2% is £403.00 Duty. An additional £773.50 a year Duty.

I’ve based all these figures on the Packaged Duty rates as that is now the base rate for each category. Original plans were that the Draught Duty rate would be a percentage of the Packaged Duty rate, but that’s not what the government have decided to do.

These are all dummy production figures that help to explain how the new system works, and it may well be that a producer of both beer and cider is paying less annually due to the new system working on the amounts of pure alcohol produced, and not overall quantities and therefore saving money on the beer Duty.

The Duty Rates and lookup tables used, however, are the new rates that are set to come into effect from 1st August 2023.

Until breweries and cideries start adding their production volumes we won’t know for sure whether this system is better or worse for our independent producers.

To that end, I’m making this spreadsheet used in this article available for anyone to download and use and will happily talk people through it if needed. It has not only the Duty Rates shown in this article, but also the new lookup tables published by the government.

Hello. Looks interesting. Where are you getting the bands from? Is there a published lookup table?

The spreadsheets attached in the last paragraph have the lookup tables in them.

The first is the one published by the government as part of the latest draft legislation for the changes which can be found here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1106005/Draft_legislation.pdf but is based on the current Duty rates, not the ones announced as part of the latest Budget.

The second uses a “best guess” look up table based on the new Duty rates and the formula that seems to have been used to work out the cumulative discount rates.

A quote from above ‘This is a massive benefit for cider makers adding fruits and hops to their ciders. Previous at a current rate of 126.08 pence per litre, for those 500 litres that they produce they would have paid £630.40 in Duty’

Absolutely wipes out traditional cider makers using apples that they grow with all the work this entails. Now, we have to compete with chemists with IBC’s of water and corn syrup mixed with ‘flavours’ like bubble gum, Mango, Rhubarb and custard etc. paying no duty, no VAT either most probably.

Traditional cider makers get to make more cider without paying Duty than they previously did.

As for the quality, there is a government consultaion due later this year to look at the definition of cider and made wine, and there really should be a concerted effort by all cider producers to get the minimum level of apple/pear juice raised to prevent the types of fizzy drinks you refer to from being classed as made wine. Yet I’m not seeing anything from any cider producers, consumer organisations or trade bodies to this effect.